Bank Draft Meaning for Beginners

Wiki Article

The Only Guide to Bank

Table of ContentsBank Reconciliation Can Be Fun For AnyoneAll About BankingAll About Bank AccountMore About Bank Account Number

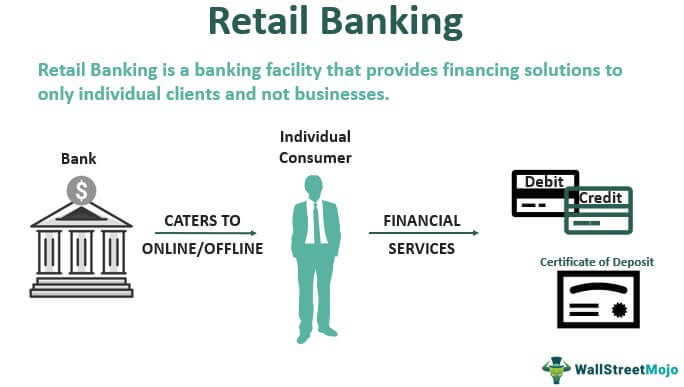

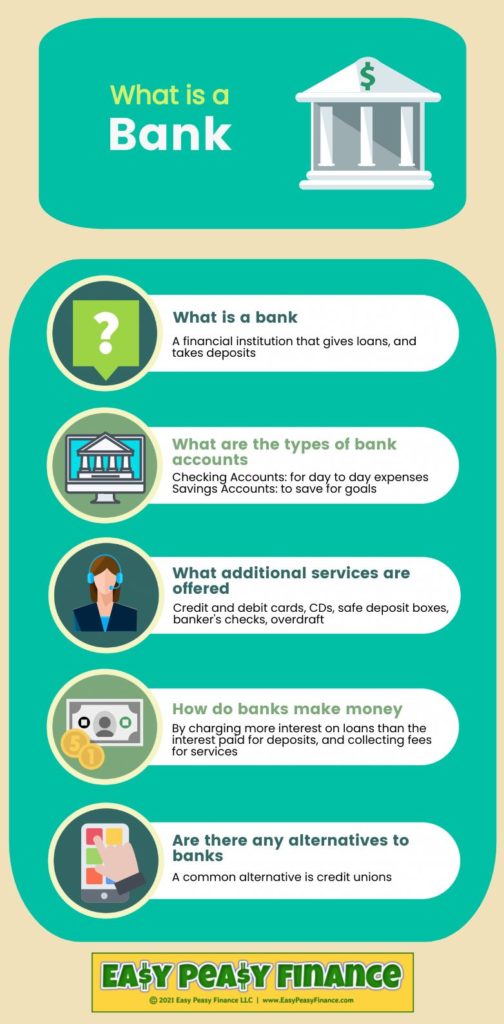

You can likewise save your money and also gain interest on your financial investment. The cash saved in most savings account is federally guaranteed by the Federal Down Payment Insurance Coverage Corporation (FDIC), approximately a limit of $250,000 for specific depositors and $500,000 for jointly held down payments. Banks additionally give credit rating opportunities for people and firms.

Financial institutions make an earnings by charging more passion to borrowers than they pay on interest-bearing accounts. A financial institution's dimension is established by where it is located as well as who it servesfrom tiny, community-based organizations to big business financial institutions. According to the FDIC, there were simply over 4,200 FDIC-insured industrial banks in the USA as of 2021.

Comfort, rate of interest rates, and charges are some of the factors that help consumers choose their favored financial institutions.

The Basic Principles Of Bank Reconciliation

The regulatory environment for banks has actually since tightened up significantly as an outcome. U.S. financial institutions are managed at a state or nationwide degree. State financial institutions are controlled by a state's division of financial or department of monetary organizations.

A area financial institution, as an example, takes down payments and also provides locally, which might supply an extra personalized banking relationship. Select a convenient location if you are choosing a bank with a brick-and-mortar location. If you have a financial emergency situation, you don't intend to have to travel a far away to obtain cash money.

The Ultimate Guide To Bank

Some financial institutions additionally supply mobile phone apps, which can be beneficial. Some big financial institutions are moving to finish over-limit charges in 2022, so that could be an important consideration.Finance & Advancement, March 2012, Vol (bank account number). 49, No. 1 Institutions that pair up savers and debtors assist make certain that economies function smoothly YOU'VE obtained $1,000 you don't need for, say, a year as well as intend to earn income from the cash till after that. Or you want to acquire a house and need to borrow $100,000 and pay it back over 30 years.

That's where financial institutions come in. Financial institutions do many points, their primary role is to take in fundscalled depositsfrom those with money, swimming pool them, and also lend them to those that need funds. Financial institutions are intermediaries between depositors (that offer cash to the financial institution) and borrowers (to whom the bank lends money).

Down payments can be readily available on need (a visit this site right here checking account, for instance) or with some restrictions (such as cost savings as well as time deposits). While at any provided moment some depositors require their cash, the majority of do not.

Getting My Banking To Work

The process entails maturity transformationconverting temporary responsibilities (down payments) to long-term properties (lendings). Financial institutions pay depositors much less than they receive from borrowers, and that distinction represent the mass of banks' revenue in the majority of countries. Banks can match typical deposits as a resource of funding by straight borrowing in the cash as well as resources markets.

Financial institutions keep those needed reserves on deposit with reserve banks, such as the United State Federal Get, the Financial Institution of Japan, and the European Reserve Bank. Financial institutions produce cash when they offer the rest browse around this web-site of the money depositors offer them. This money can be utilized to acquire products as well as services as well as can bank employee in japanese locate its way back right into the banking system as a down payment in an additional bank, which then can lend a fraction of it.

The dimension of the multiplierthe amount of cash developed from a first depositdepends on the quantity of cash financial institutions need to keep book (banking). Banks additionally lend as well as recycle excess money within the economic system and create, distribute, as well as profession safety and securities. Financial institutions have several methods of generating income besides stealing the distinction (or spread) in between the passion they pay on deposits and also borrowed cash and the rate of interest they gather from customers or securities they hold.

Report this wiki page